In the dynamic world of trading, understanding how institutional players operate can set you apart from the crowd. Smart Money Concepts (SMC) empower retail traders to align their strategies with the logic of market makers, enabling them to navigate the complexities of the financial markets more effectively. By employing the ICT (Inner Circle Trader) strategy, traders can learn to identify critical price movements and patterns that signal potential market shifts. This blog post delves into the essence of Smart Money Concepts, unraveling the intricacies of trading like institutions and revealing the tools necessary for success.

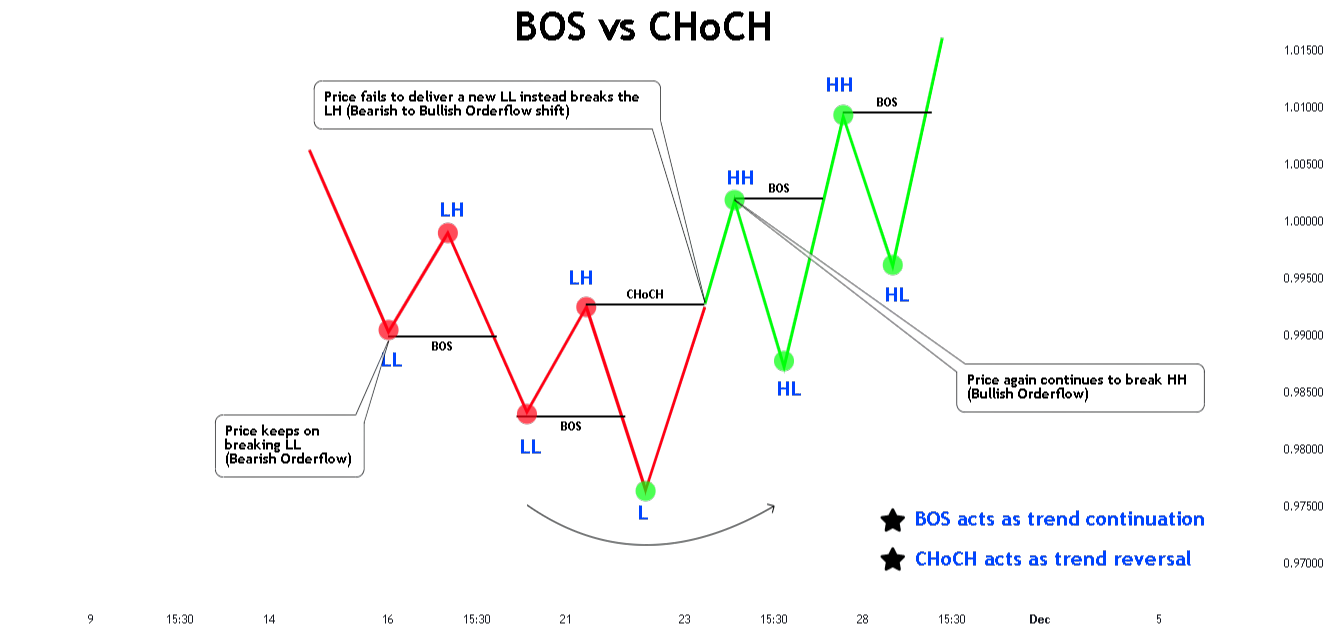

As we explore this topic, we'll break down key elements such as Break of Structure (BOS), Change of Character (CHoCH), and essential liquidity zones. Understanding these concepts not only enhances your trading knowledge but also equips you to recognize the footprints left by institutions in the market. Whether you're a novice or an experienced trader, mastering these strategies can significantly improve your approach to trading. Join us as we unpack the Smart Money Concepts and the ICT strategy, helping you transform your trading style and make informed decisions that align with the actions of the financial giants.

Understanding smart money concepts and their importance in trading

Smart Money Concepts (SMC) represent a shift in how traders perceive market movements and price actions. Traditional trading approaches often rely on technical indicators and historical patterns, but SMC encourages traders to align their strategies with the logic of institutional investors. Understanding this framework allows retail traders to recognize when an institution is likely to enter or exit the market, providing a competitive edge. By focusing on the behaviors of market makers, traders can better predict price movements and identify potential trading opportunities.

The significance of Smart Money Concepts lies in their ability to illuminate the often-hidden dynamics of the financial markets. By studying the footprints left by institutions, traders can decode specific signals that represent a forthcoming shift in price direction. Concepts like liquidity grabs and Break of Structure (BOS) serve as indicators that reveal when big players are manipulating price to their advantage. This insight empowers traders to make informed decisions, minimizing risks while maximizing profit potential by trading alongside the institutions rather than against them.

Unraveling key strategies: BOS, CHoCH, and liquidity zones

Break of Structure (BOS) is a fundamental concept in Smart Money Concepts that helps traders identify potential reversals and trend continuations. When price breaks through a significant support or resistance level, it signals a shift in market sentiment. Recognizing these breaks allows traders to align their positions with institutional movements, increasing the likelihood of capturing profitable trades. By understanding when a BOS occurs, traders can position themselves advantageously before the crowd follows the trend, capitalizing on price movements that align with institutional strategies.

Similarly, the Change of Character (CHoCH) indicates a potential shift in the market's structure, helping traders identify turning points. When price enters a new trading range after rejecting previous support or resistance, it signals a CHoCH. This concept is crucial in understanding shifts in market dynamics, as it reveals when traders might transition from bullish to bearish sentiments and vice versa. Additionally, liquidity zones play a vital role in trading strategies, as they represent areas where price tends to gravitate due to the presence of buy or sell orders. By analyzing these liquidity zones, traders can enter trades that align with the movements of institutional players, allowing them to trade like the pros.

Mastering the ICT strategy for institutional trading success

The ICT (Inner Circle Trader) strategy serves as a crucial framework for traders aspiring to think and act like institutional players. By focusing on market structure, the ICT strategy helps traders identify key areas where institutions are likely to enter or exit positions. This method encourages practitioners to look for optimal trade entries based on market behavior rather than relying solely on traditional indicators. Understanding the intricacies of price movements allows traders to pinpoint their entries at premium and discount levels, increasing the potential for higher reward-to-risk ratios.

Moreover, implementing techniques such as Order Blocks and Fair Value Gaps enhances one’s ability to navigate market fluctuations effectively. Order Blocks represent price levels where significant buying or selling occurred, indicating potential reversal zones. Meanwhile, Fair Value Gaps highlight areas in the market where prices have not had sufficient time to consolidate, providing opportunities to enter after a liquidity grab. By mastering the ICT strategy, traders can better align their actions with institutional flows, enabling them to make informed decisions that capitalize on market dynamics. Ultimately, this mastery transforms retail traders into savvy market participants who harness the principles of Smart Money Concepts for sustained trading success.